It is all too easy to neglect current vendor relationships when there is no crisis or obvious decision point in sight. But to do so is to miss a great opportunity to be strategic and proactive in your Supplier Relationship Management (SRM). Being more involved and hands-on after you’ve selected a vendor can help you and your company build more valuable and productive relationships. And it can help you realize, in a timely manner, when it might make sense to consider changing vendors.

Of course, you’re busy. Probably very busy. So, how can you realistically implement an SRM plan? We have a simple yet strategic tool that could help and that you can adapt and scale to fit your needs.

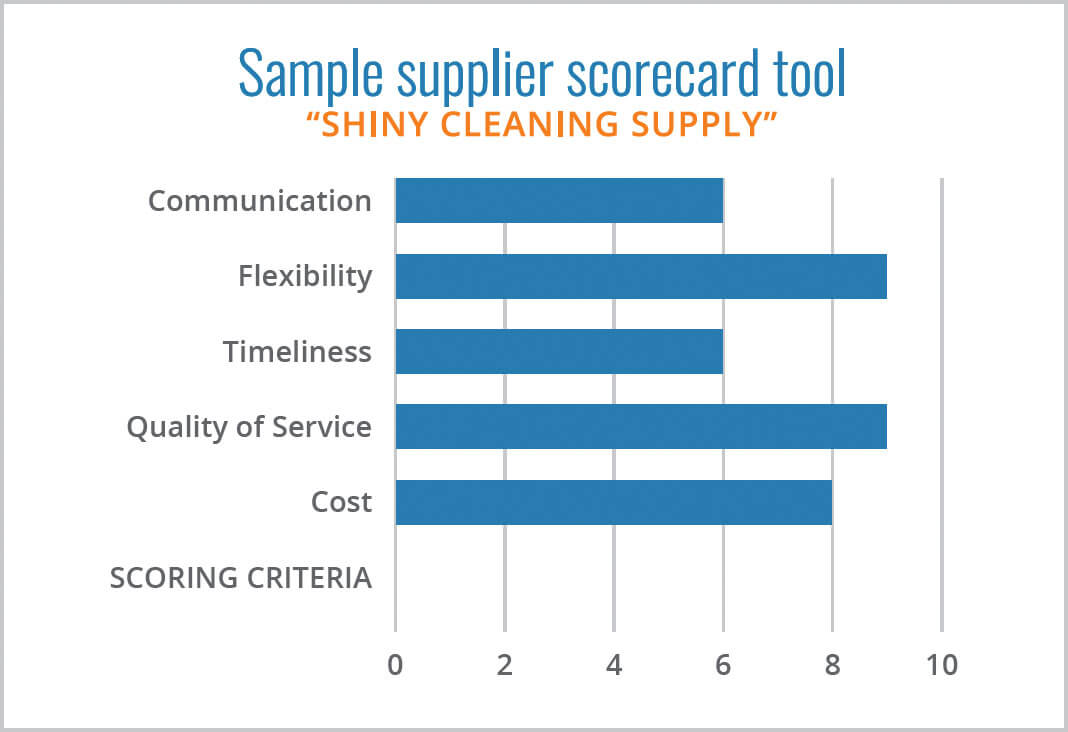

Our Supplier Scorecard lets you measure vendor performance and share that information with your internal partners and your vendors so that you can assess and improve vendor relationships. We’ll walk you through the process, but first let’s skip right to the punchline and take a look at a Supplier Scorecard and the insights it can offer.

The Sample Supplier Scorecard shown below assesses a hypothetical vendor, Shiny Cleaning Supply. They are rated on six categories, each on a scale of 1 to 10, with 1 being the worst and 10 being the best. A quick glance shows us a couple of useful things.

Case Study – Shiny Cleaning Supply Company

When it comes to Flexibility, Quality of Service, and Cost, Shiny Cleaning Supply is doing very well. Timeliness and Communication look to be problem areas. A bit of further investigation may show that these two are closely linked. Let’s say that Shiny Cleaning Supply is often hard to communicate with and not timely in their responses to requests. Maybe these problems are traceable to one or several Shiny employees or a particular type of communication.

Because Shiny will already be familiar with the scorecard tool and what they are being assessed on, when issues like the above arise, it’s best practice to set up a meeting and generate a plan for improvement as the next step. Hopefully you’ll see improvement and if not you’ll be able seek out new prospective vendors, which you can assess using our Ideal Supplier Map Tool.

Let’s back up and explain the process.

First, identify what you want to measure. Think about what is most important to your company when it comes to vendor relationships. Cost is a concern for almost everyone, but likely quality of service, communication and product quality are also very important. For each dimension, we recommend that in addition to a title, such as “Timeliness,” that you also develop a description. For example: Are deadlines met in a timely manner? Does business proceed without delays? If you can include particular benchmarks or quantitative measures, do so. This description will make it so that everyone in your organization and your vendors understand the criteria you are using. To make it manageable but also sufficiently detailed, we’d suggest choosing between 4 and 8 categories.

Once you’ve identified your categories, decide on a scoring or weighting system. In our example, all categories are weighted equally and we’ve used a scale of 1 to 10. You could, for example, create a system that totals to 100 possible points. Or if product quality is most important for your company, you can weight that more heavily.

Second, share your scorecard. Share it first with internal stakeholders and then with your vendors. Most vendors will be happy to know the criteria against which they are being measured. At AMI, we certainly love knowing what is most important to our clients, what we’ve done well, and what could use improvement. Explain to your vendors why you’re developing a supplier scorecard and that you’re committed to long-term collaborative vendor relationships. In rolling out your scorecard, it can be a good idea to let your vendors have some input and also to allow for a trial period during which data is collected but not acted upon.

Third, implement, monitor, and refine as needed. You may want to set up regular reporting intervals, perhaps quarterly. And you’ll also want to establish general processes for addressing unsatisfactory vendor performance. In most cases, you’ll probably want to give your vendor a chance to improve. But if that improvement is not forthcoming, you are then equipped to make a strategic choice about changing vendors. If you need help assessing and choosing vendors, please see our previous blog post, which includes our Ideal Supplier Map Tool.

To get started, download our Supplier Scorecard Tool here.

We like the Supplier Scorecard approach because it is scalable and adaptable. You can always add elements to your scoring and measurement system, and it’s relatively easy to get started quickly. We hope you adapt these ideas for your company and find this a valuable tool.

Want to talk more about developing criteria to evaluate potential or current Meetings and Events suppliers? Contact us at (866) 337-7799 or bd@AmericanMeetings.com.